work opportunity tax credit questionnaire (wotc)

If so you will need to complete the questionnaire when you. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers for hiring individuals from specific target groups who have consistently faced significant barriers to.

Wotc Questionnaire Fill And Sign Printable Template Online Us Legal Forms

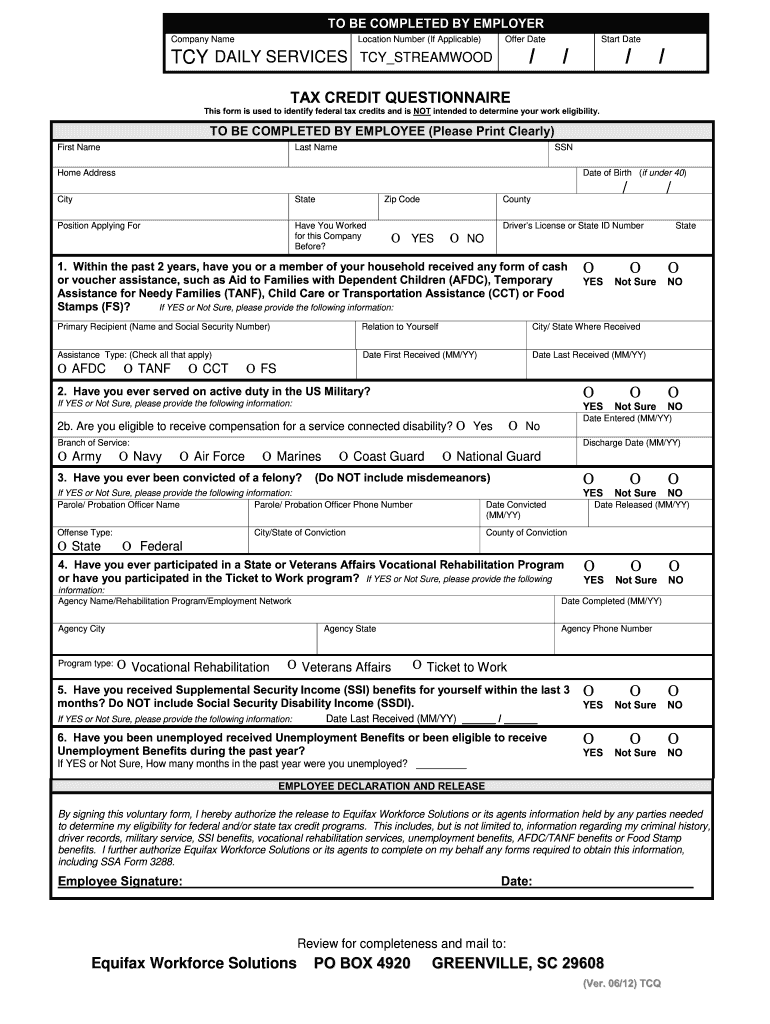

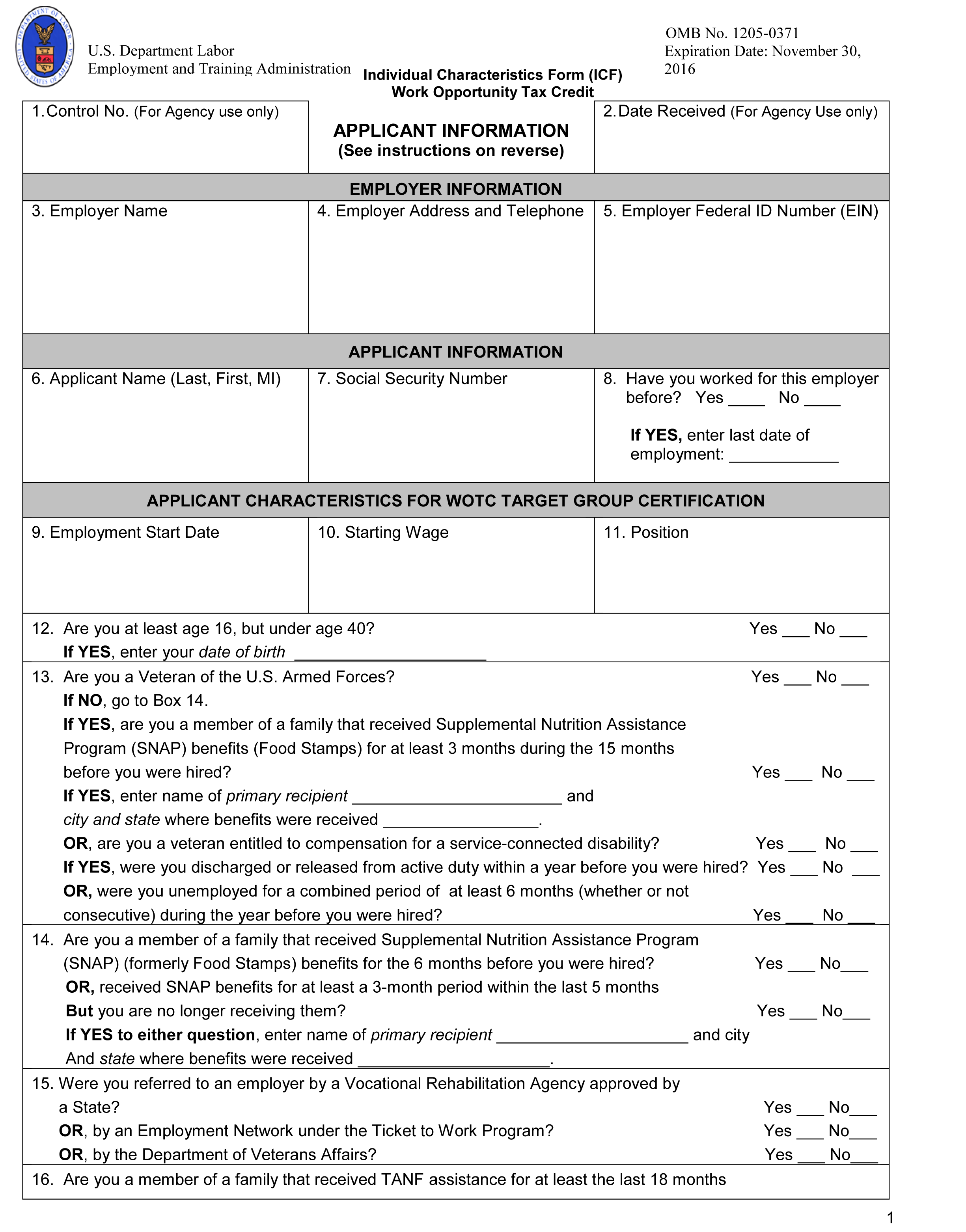

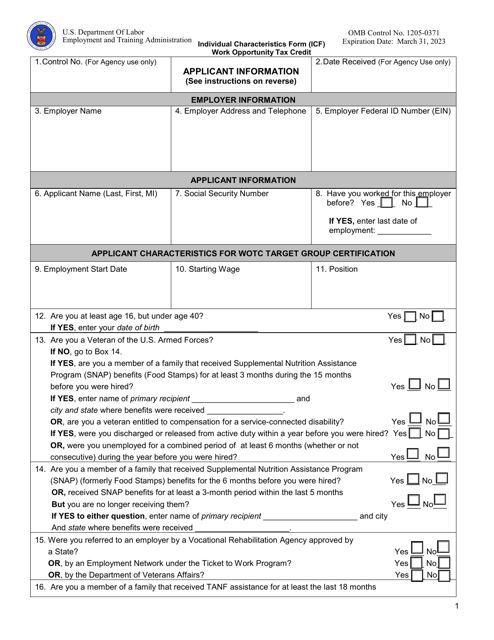

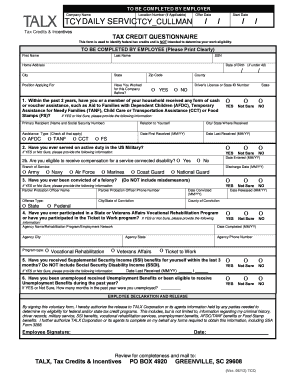

The employer and the job seeker must complete the Pre-Screening Notice and Certification Request for the Work Opportunity Tax Credits IRS Form 8850 and sign under.

. Hi the Work Opportunity Tax Credit Questionnaire is a questionnaire that employers give to their new hires. 40 for those employed at least 400 hrs maximum credit 2400. The program has been designed to promote the.

Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. Work Opportunity Tax Credit questionnaire. Questions and answers about the Work Opportunity Tax Credit program.

Auxiliary aids and services are available upon request to individuals with disabilities. The Work Opportunity Tax Credit WOTC is a federal tax credit that the government provides to private-sector businesses for hiring individuals from nine target groups that have historically. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who hire and retain individuals from target groups with significant employment.

The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. The Work Opportunity Tax Credit WOTC is a federal tax credit available to businesses that hire individuals from certain target groups who have consistently faced significant barriers to. We would like you to know that although this questionnaire is.

An equal opportunity employerprogram. Work Opportunity Tax Credit Questionnaire. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers rewarding them for every new hire who meets eligibility requirements potential energy Aviontés recruiting.

Ad TALX Tax Credit Questionnaire More Fillable Forms Register and Subscribe Now. Please take this opportunity to complete an additional applicant assessment. Work Opportunity Tax Credit WOTC When you hire people from targeted categories and employ them for at least 120 hours you can reduce your federal tax liability by up to 9600 per eligible.

All voice telephone numbers on this website may be reached by. Is participating in the WOTC program offered by the government. The tax credit for WOTC new hires except LTFA is.

The Work Opportunity Tax Credit WOTC is a federal tax credit that the government provides to private-sector businesses for. As the WOTC can. 25 for those employed at least 120 hrs maximum credit 1500.

It asks the applicant about any military service participation in government assistance. The Work Opportunity Tax Credit WOTC can help you get a job If you are in one of the target groups listed below an employer who hires you could receive a federal tax credit. A work opportunity tax credit questionnaire helps to find out whether a company is following the Work Opportunity tax credit program as directed by the Federal government.

Work Opportunity Tax Credit questionnaire Page one of Form 8850 is the WOTC questionnaire. Hiring certain new employees can qualify the employer for the Work Opportunity Tax Credit WOTC which Congress extended for one additional year so that it is now available for wages. Completing Your WOTC Questionnaire.

The program has been designed to promote. Page one of Form 8850 is the WOTC questionnaire. What is the Work Opportunity Tax Credit Questionnaire.

WOTC Work Opportunity Tax Credit Questionnaire KS Staffing Solutions Inc. Does your company claim the Work Opportunity Tax Credit WOTC a federal tax credit designed to encourage businesses to hire individuals from certain targeted groups. The Leading Online Publisher of National and State-specific Legal Documents.

Secured taxable employers claim the WOTC as a general business credit against their income taxes and tax-exempt employers claim the WOTC against their payroll taxes.

Edocument 9061 Wotc Form Avionte Classic

Eta Form 9061 Download Fillable Pdf Or Fill Online Individual Characteristics Form Icf Work Opportunity Tax Credit Templateroller

Adp Work Opportunity Tax Credit Wotc Avionte Bold

2015 Form Irs 8850 Fill Online Printable Fillable Blank Pdffiller

Wotc Form Fill Out And Sign Printable Pdf Template Signnow

Wotc Forms Cost Management Services Work Opportunity Tax Credits Experts

Wotc Questions How Much Do You Get With Each Category Cost Management Services Work Opportunity Tax Credits Experts

Work Opportunity Tax Credit First Advantage

Retrotax Tax Credit Administration Jazzhr Marketplace

Work Opportunity Tax Credits Wotc Walton

Wotc By The Numbers Wotc Certifications Issued By Target Group 2008 2012 Cost Management Services Work Opportunity Tax Credits Experts

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Work Opportunity Tax Credit What Is Wotc Adp

With Wotc Timing Is Everything Wotc Planet

Application Workflow Work Opportunity Tax Credit Wotc Avionte Aero

How To Make Wotc A Part Of Your Onboarding Process Irecruit Applicant Tracking Remote Onboarding

Dol Issues Revised Forms For Work Opportunity Tax Credit Wotc Wotc Planet

Completing My Work Opportunity Tax Credit Wotc Eligibility Questionnaire